Thought Leadership

How great britain wants to digitalize its tax administration

BREXIT is not the only important subject in Britain these days. At least it’s what thinks HMRC (Her Majesty Revenue & Customs) the British Tax Administration. HMRC aims to become one of the most advanced tax administrations as far digitalization is concerned. This is “Make Tax Digital” Project, MTD in short. An article written by Alain, SAP Business One project manager, VISEO.

It starts with VAT declaration as of first of April 2019. Sorry it’s not a joke. Depending on company’s turnover, the electronic media will be mandatory for the first declaration following First of April 2019, given that some companies may ask to postpone the obligation to October.

Other taxes will be included in the following years.

The firsts steps to digitisation

In short, companies have to establish a permanent connection through Internet between their ERP and the Tax Authority.

HMRC will periodically send “obligations” to the company through that channel.

Companies will use built-in ERP’s reports to fulfill these obligations (a.k.a. send reports) using the same media in due format and time.

No declaration would be possible if HMRC has not sent any obligation. It’s therefore important to be connected before declaration is needed. On the other hand, it’s possible to connect after 1st of April as long as declaration takes the full period into account and is provided in time.

Sap Business One uses B1if for connection back and forth HMRC and BAS (Business Activities Assessments) reports to generate the declarations. It’s included in UK Customization starting with release 9.3 PL08 and above, available since December 2018.

To be more specific with Sap Business One set-up

It starts with customizing:

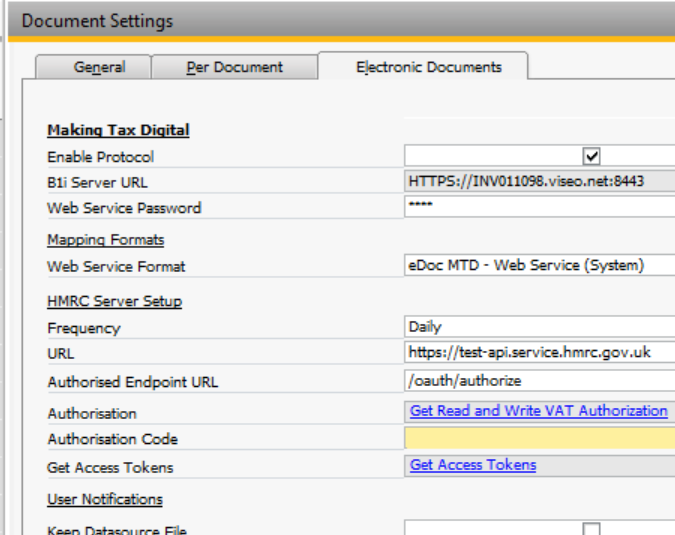

MTD activation in Company Details, BAS codes customization and the heart of it: Documents settings

Next step is Installing B1if, importing package provided with B1 release (eDocsWS-MTD) and activating it.

Once ready, it’s time to connect to HMRC using above links in “Documents Settings”. It’s also possible to require test credentials from there.

When connection is established and access granted, HMRC will send obligations to Sap Business One.

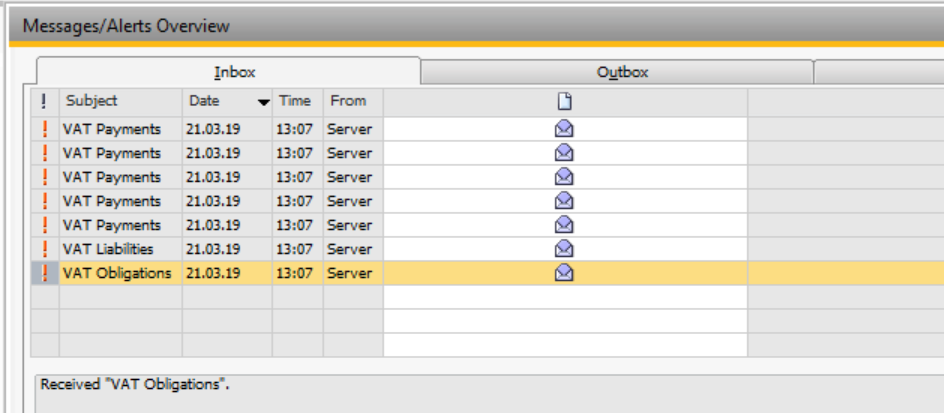

They will generate alerts in the system:

Users will find details of the 4 types in menu “Electronic Document Monitor”: VAT Obligations, VAT Declarations, VAT Liabilities and VAT Payments.

-

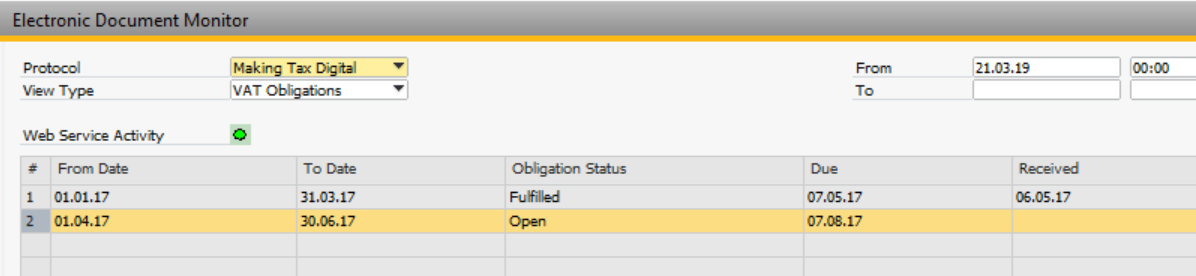

For example, VAT obligations:

-

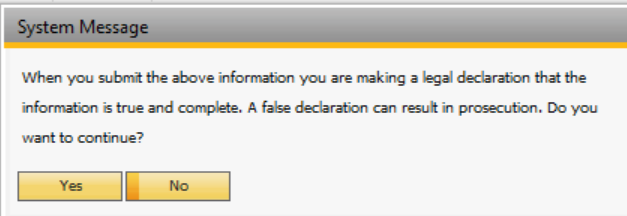

Fulfilling the obligation (a.k.a. sending declaration) is a 2 steps process in Sap Business One

-

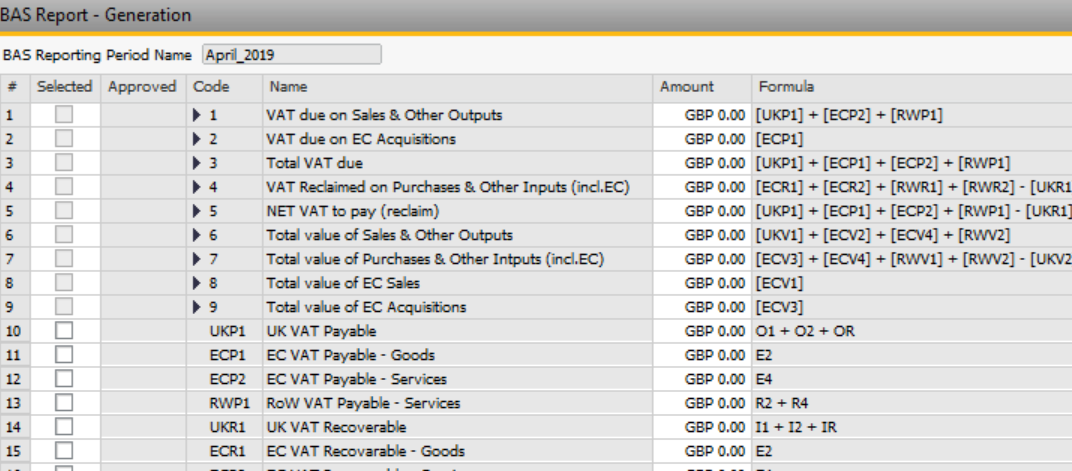

Create a BAS Report with menu ”BAS Report Generation”

-

Submit the report by exporting it straight from menu “BAS Report Retrieval”

The whole installation process is rather straightforward, given that problems may always arise, especially as far communications are concerned.

SAP has provided a useful “How-To” guide to ease the setup. There is also a SAP Jam group dedicated to MTD.

HMRC has decided to enter Digitalization era right now

Next steps (other taxes) will be included shortly afterwards in UK, may be elsewhere in Europe, not forgetting what already exists in other places as far electronic declarations are concerned; in Brazil for example.

SAP B1if enforces once again its central role as communication masterpiece in Business One world. With that tool, SAP Business One is ready for MTD and will clearly follow next evolutions easily.